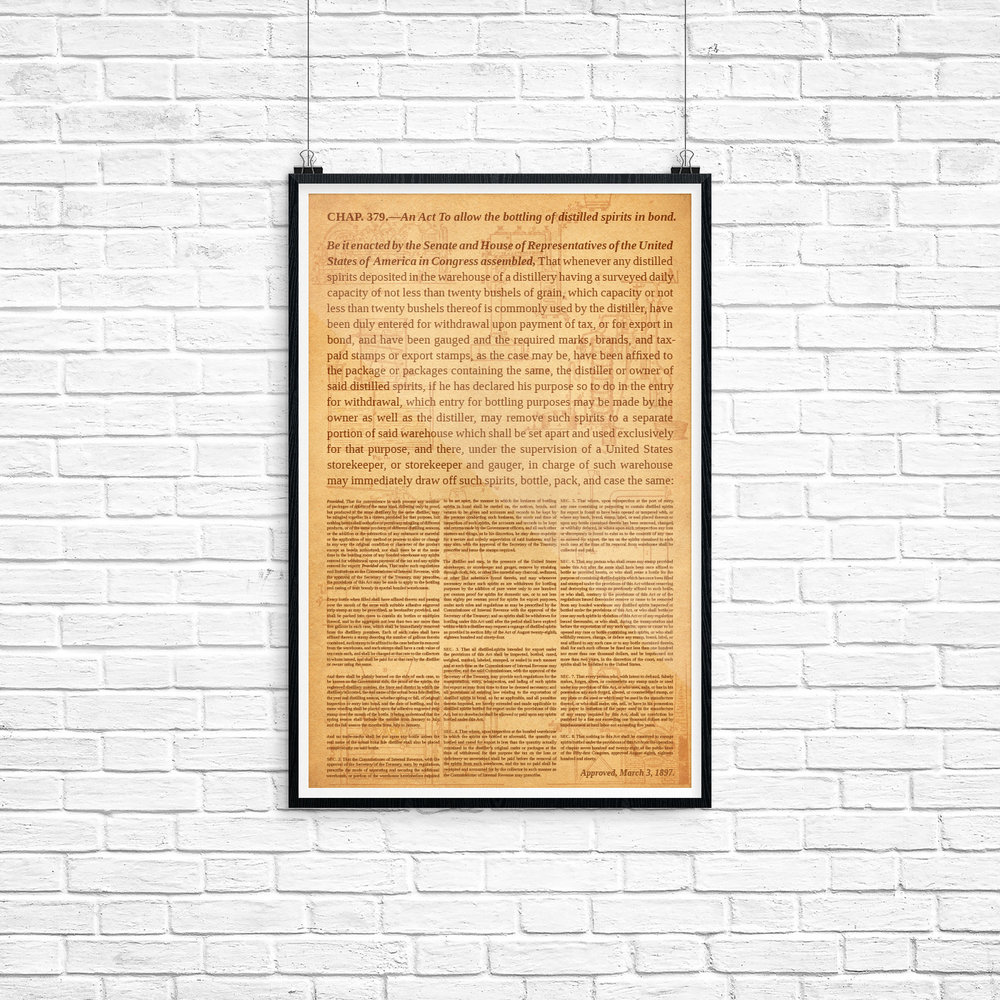

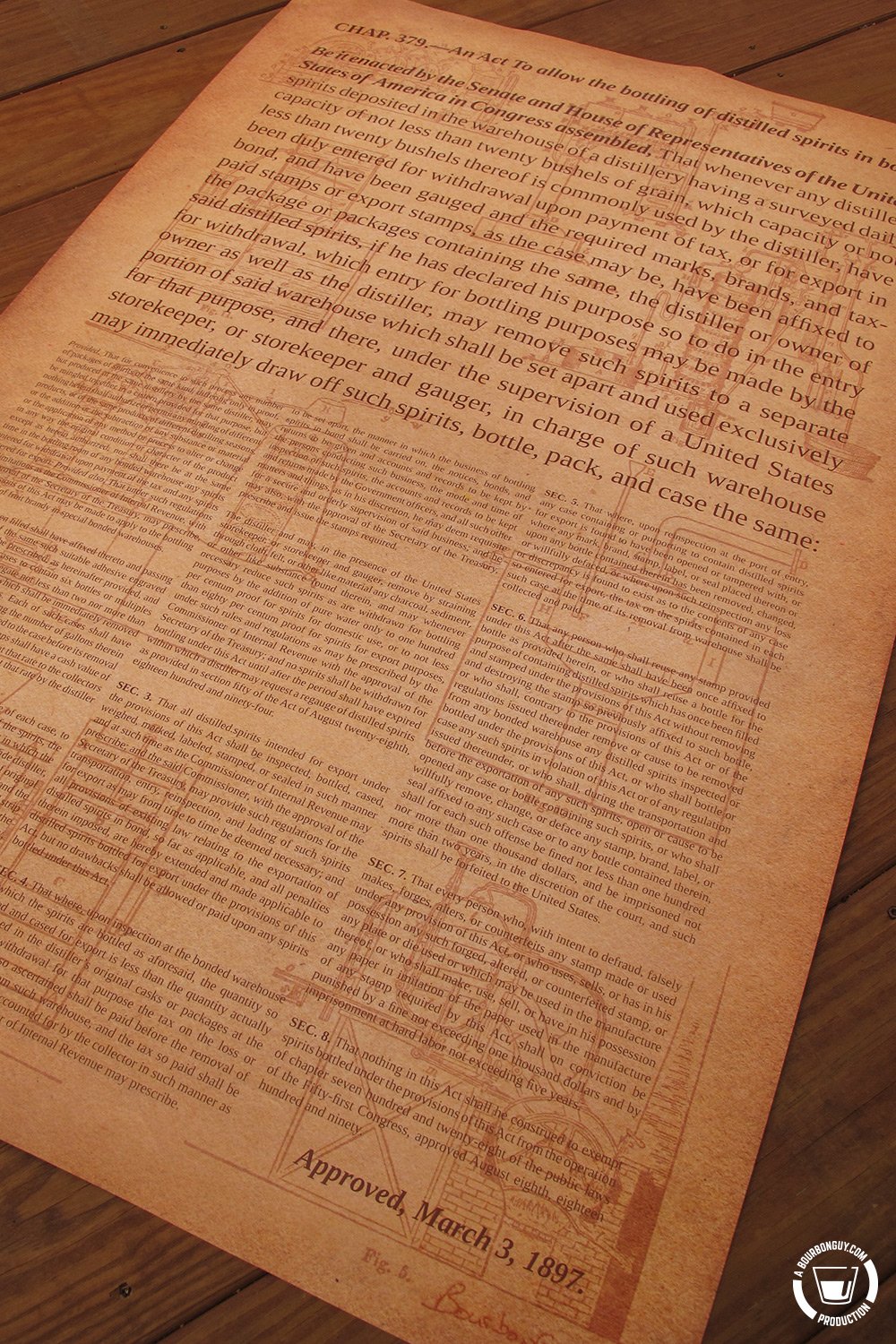

As I write this, it is currently the 125th Anniversary of the passage of the Bottled in Bond Act of 1897. Because one of my best-selling products in the BourbonGuyGifts.com Store is a poster of the Bottled-in-Bond Act, I’d like to offer a 10% discount on orders over $35 until March 10, 2022. It’s a site-wide sale. No need for a coupon code.

The poster is printed on thick, high-quality paper. It features the entire text of the Bottled-in-Bond Act of 1897 and images from an 1800’s era distilling handbook. Honestly, folks, it is one of my favorite things that I’ve designed in over 20 years of being a professional designer. And I’m not just saying that in order to get you to support the site. I have one of these hanging in my living room. (And because you are a reader of BourbonGuy.com, if I’m out of the poster for some reason, send me a note and I’ll be happy to reorder and give you the same discount when I get more in.)

Of course, if you don’t want a poster of a 125-year-old law, maybe you want one that contains some good cocktails. Or maybe you don’t want a poster at all. I get that. I also have a tasting journal that people seem to like, hand-made by me with a wood cover. My wife takes all her notes in them. I also offer bourbon-themed stickers, lapel pins, and keychains. Honestly, I felt like this was an appropriate day to share all the fun things that keep the site running.

View fullsize

View fullsize

View fullsize

View fullsize

View fullsize

View fullsize

In celebration of the day, below is the entire text of the act that helped make Bourbon what it is 125 years ago:

CHAP. 379.—An Act To allow the bottling of distilled spirits in bond.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That whenever any distilled spirits deposited in the warehouse of a distillery having a surveyed daily capacity of not less than twenty bushels of grain, which capacity or not less than twenty bushels thereof is commonly used by the distiller, have been duly entered for withdrawal upon payment of tax, or for export in bond, and have been gauged and the required marks, brands, and tax- paid stamps or export stamps, as the case may be, have been affixed to the package or packages containing the same, the distiller or owner of said distilled spirits, if he has declared his purpose so to do in the entry for withdrawal, which entry for bottling purposes may be made by the owner as well as the distiller, may remove such spirits to a separate portion of said warehouse which shall be set apart and used exclusively for that purpose, and there, under the supervision of a United States storekeeper, or storekeeper and gauger, in charge of such warehouse may immediately draw off such spirits, bottle, pack, and case the same:

Provided, That for convenience in such process any number of packages of spirits of the same kind, differing only in proof, but produced at the same distillery by the same distiller, may be mingled together in a cistern provided for that purpose, but nothing herein shall authorize or permit any mingling of different products, or of the same products of different distilling seasons, or the addition or the subtraction of any substance or material or the application of any method or process to alter or change in any way the original condition or character of the product except as herein authorized; nor shall there be at the same time in the bottling room of any bonded warehouse any spirits entered for withdrawal upon payment of the tax and any spirits entered for export: Provided also, That under such regulations and limitations as the Commissioner of Internal Revenue, with the approval of the Secretary of the Treasury, may prescribe, the provisions of this Act may be made to apply to the bottling and casing of fruit brandy in special bonded warehouses.

Every bottle when filled shall have affixed thereto and passing over the mouth of the same such suitable adhesive engraved strip stamp as may be prescribed, as hereinafter provided, and shall be packed into cases to contain six bottles or multiples thereof, and in the aggregate not less than two nor more than five gallons in each case, which shall be immediately removed from the distillery premises. Each of such cases shall have affixed thereto a stamp denoting the number of gallons therein contained, such stamp to be affixed to the case before its removal from the warehouse, and such stamps shall have a cash value of ten cents each, and shall be charged at that rate to the collectors to whom issued, and shall be paid for at that rate by the distiller or owner using the same.

And there shall be plainly burned on the side of each case, to be known as the Government side, the proof of the spirits, the registered distillery number, the State and district in which the distillery is located, the real name of the actual bona fide distiller, the year and distilling season, whether spring or fall, of original inspection or entry into bond, and the date of bottling, and the same wording shall be placed upon the adhesive engraved strip stamp over the mouth of the bottle. It being understood that the spring season shall include the months from January to July, and the fall season the months from July to January.

And no trade-marks shall be put upon any bottle unless the real name of the actual bona fide distiller shall also be placed conspicuously on said bottle.

SEC. 2. That the Commissioner of Internal Revenue, with the approval of the Secretary of the Treasury, may, by regulations, prescribe the mode of separating and securing the additional warehouse, or portion of the warehouse hereinbefore required to be set apart, the manner in which the business of bottling spirits in bond shall be carried on, the notices, bonds, and returns to be given and accounts and records to be kept by the persons conducting such business, the mode and time of inspection of such spirits, the accounts and records to be kept and returns made by the Government officers, and all such other matters and things, as in his discretion, he may deem requisite for a secure and orderly supervision of said business; and he may also, with the approval of the Secretary of the Treasury, prescribe and issue the stamps required.

The distiller and may, in the presence of the United States storekeeper, or storekeeper and gauger, remove by straining through cloth, felt, or other like material any charcoal, sediment, or other like substance found therein, and may whenever necessary reduce such spirits as are withdrawn for bottling purposes by the addition of pure water only to one hundred per centum proof for spirits for domestic use, or to not less than eighty per centum proof for spirits for export purposes, under such rules and regulations as may be prescribed by the Commissioner of Internal Revenue with the approval of the Secretary of the Treasury; and no spirits shall be withdrawn for bottling under this Act until after the period shall have expired within which a distiller may request a regauge of distilled spirits as provided in section fifty of the Act of August twenty-eighth, eighteen hundred and ninety-four.

SEC. 3. That all distilled.spirits intended for export under the provisions of this Act shall be inspected, bottled, cased, weighed, marked, labeled, stamped, or sealed in such manner and at such time as the Commissioner of Internal Revenue may prescribe; and the said Commissioner, with the approval of the Secretary of the Treasury, may provide such regulations for the transportation, entry, reinspection, and lading of such spirits for export as may from time to time be deemed necessary; and all provisions of existing law relating to the exportation of distilled spirits in bond, so far as applicable, and all penalties therein imposed, are hereby extended and made applicable to distilled spirits bottled for export under the provisions of this Act, but no drawbacks shall be allowed or paid upon any spirits bottled under this Act.

SEC. 4. That where, upon inspection at the bonded warehouse in which the spirits are bottled as aforesaid, the quantity so bottled and cased for export is less than the quantity actually contained in the distiller’s original casks or packages at the time of withdrawal for that purpose the tax on the loss or deficiency so ascertained shall be paid before the removal of the spirits from such warehouse, and the tax so paid shall be receipted and accounted for by the collector in such manner as the Commissioner of Internal Revenue may prescribe.

SEC. 5. That where, upon reinspection at the port of entry, any case containing or purporting to contain distilled spirits for export is found to have been opened or tampered with, or where any mark, brand, stamp, label, or seal placed thereon or upon any bottle contained therein has been removed, changed, or willfully defaced, or where upon such reinspection any loss or discrepancy is found to exist as to the contents of any case so entered for export, the tax on the spirits contained in each such case at the time of its removal from warehouse shall be collected and paid.

SEC. 6. That any person who shall reuse any stamp provided under this Act after the same shall have been once affixed to bottle as provided herein, or who shall reuse a bottle for the purpose of containing distilled spirits which has once been filled and stamped under the provisions of this Act without removing and destroying the stamp so previously affixed to such bottle, or who shall, contrary to the provisions of this Act or of the regulations issued thereunder remove or cause to be removed from any bonded warehouse any distilled spirits inspected or bottled under the provisions of this Act, or who shall bottle or case any such spirits in violation of this Act or of any regulation issued thereunder, or who shall, during the transportation and before the exportation of any such spirits, open or cause to be opened any case or bottle containing such spirits, or who shall willfully remove, change, or deface any stamp, brand, label, or seal affixed to any such case or to any bottle contained therein, shall for each such offense be fined not less than one hundred nor more than one thousand dollars, and be imprisoned not more than two years, in the discretion of the court, and such spirits shall be forfeited to the United States.

SEC. 7. That every person who, with intent to defraud, falsely makes, forges, alters, or counterfeits any stamp made or used under any provision of this Act, or who uses, sells, or has in his possession any such forged, altered, or counterfeited stamp, or any plate or die used or which may be used in the manufacture thereof, or who shall make, use, sell, or have in his possession any paper in imitation of the paper used in the manufacture of any stamp required by this Act, shall on conviction be punished by a fine not exceeding one thousand dollars and by imprisonment at hard labor not exceeding five years.

SEC. 8. That nothing in this Act shall he construed to exempt spirits bottled under the provisions of this Act from the operation of chapter seven hundred and twenty-eight of the public laws of the Fifty-first Congress, approved August eighth, eighteen hundred and ninety.

Approved, March 3, 1897.

Did you enjoy this post? If so, maybe you’d like to buy me a cup of coffee in return. Go to ko-fi.com/bourbonguy to support. And thank you, BourbonGuy.com is solely supported via your generosity.

Of course, if you want to support BourbonGuy.com and get a little something back in return, you can always head over to BourbonGuyGifts.com and purchase some merch. I’ve made tasting journals, stickers, pins, and more.